While the likes of Ademola Lookman, Samuel Chukwueze, and Victor Osimhen are putting up a […]

Best Ghana Soccer Players of All Time

Ghana is one of the African countries that have also produced some talented football players […]

5 Ways Megaways Slots Are Different to Regular Slots

Megaways is one of the most revolutionary mechanics to be added to online fruity machines […]

What Happens If A Goalie Gets A Red Card

“According to the foul and misconduct rules In football, If a goalie gets a red […]

What Is A Green Card In Soccer? (CONIFA Explanation)

“A green card in soccer is a rare occurrence, unlike yellow or red cards and […]

Top 10 Richest African Soccer Players

African footballers are taking over the game not just with their skills, but also with […]

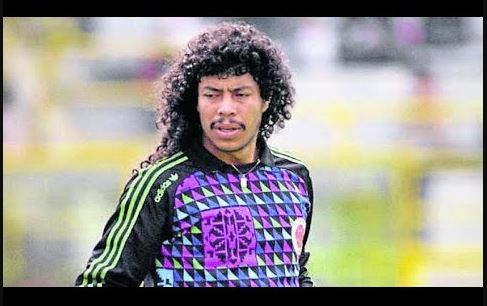

Top 10 Cameroon Soccer Players Of All Time

Do you still remember the ageless Roger Milla dancing on the corner flag at the […]

Top 10 African Coaches In Europe With UEFA Pro License

Statistics show a growing trend of African coaches obtaining UEFA Pro Licenses and pursuing careers […]

Can A Goalie Score In Soccer?

“Yes, goalies can score in football. It’s rare but it happens. Usually, it’s from a […]

Top 10 South African Football Players In Europe

Following the success of Bafana Bafana in the 1990s, South African football continues to produce […]